are you a dislocated worker fafsa

A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. Also known as disinserted workers theyve knowledgeable project loss due to scenarios beyond their manage.

Don T Make This Fafsa Mistake Fafsa College Apps Financial Information

On your FAFSA you answered Yes to the question As of today is either of your Parents or are you or your spouse a dislocated worker.

. The Department of Labor also categorizes self-employed individuals who arent working due to economic conditions or a natural disaster spouses of active-duty members of the Armed Forces who are unemployed and displaced homemakers as dislocated workers. Similarly does being a dislocated worker affect fafsa. Workers who are terminated from employment due to unsatisfactory project performance are not taken.

FAFSA considers you a dislocated worker if you lost your job or got laid off for a reason beyond your control and you dont expect to be able to work in that same role or industry again. You will need to select Yes in the application. Was Either Of Your Parents A Dislocated Worker On The Day You Submitted Your FAFSA.

If for some reason your school decides you dont qualify you can just tell them someone in your family received freereduced lunch for the previous year --- that will have the same effect as dislocated worker status on the EFC formula. Is receiving unemployment benefits due to being laid off or losing a job and is unlikely to return to a. Does being a dislocated worker affect fafsa A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award.

You must still report all income taxed and untaxed. Your parentparents are considered dislocated workers if they. What you decide to do with your money and what school you want to go to is totally up to you though and its important that you consider and really think of what is good for you.

Have been laid off. According to FAFSA dislocated worker is an occupational category that your parent or guardian may fall into. You wouldnt need to report unemployment from 2020 on any of the currently open FAFSAs.

In general a person may be considered a dislocated worker if he or she. Dislocated workers are individuals who have lost their jobs due to a layoff. These circumstances include being laid off moving due to military duty andor natural disasters.

Please check the appropriate box on this form. It sounds to me like you would be considered a dislocated worker. You are considered a dislocated worker if you.

This question asks if either you or your spouse is a dislocated worker. A dislocated worker qualification can lower your EFC and raise the amount of your federal aid award. On December 17 2021.

What Is A Dislocated Worker FAFSA. Have been laid off. Are receiving unemployment benefits as a result of being laid off.

In general a person may be considered a dislocated worker if he or she. You would be asked those additional questions combat pay child support etc regardless of how you answered the. This means any unemployment benefits relocation assistance or federal disaster aid must all be reported on your FAFSA application.

This is a parent who has lost their job out of their control. On the FAFSA dislocated worker may mean several different things. An individual who was self-employed including employment as a farmer a rancher or a fisherman but is unemployed as a result of general economic conditions in the community in which the individual resides or because of natural disasters.

This means any unemployment benefits relocation assistance or federal disaster aid must all be reported on your FAFSA application. Now you hopefully have a better understanding of what a dislocated worker is and what to do when the question pops up on the FAFSA. Dislocated workers are people who lost or quit their jobs unexpectedly or due to circumstances outside of their control.

Are a displaced homemaker stay-at-home student who has had to relocate Had been self-employed but no longer. The student for whom the FAFSA is being completed or their parent s can be a dislocated worker. It is the skip logic that causes this.

A dissituated worker is an individual that has actually shed their jobs as a result of a layoff. Before you answer you will need to check with your parents or guardians to confirm their job status. You must still report all income taxed and untaxed.

The dislocated worker question is not connected to the questions that follow. To be a dislocated worker on FAFSA your parent or guardian must be unemployed. There are other definitions as well for military spouses stay-at-home parents and individuals whose workplaces are shutting down within 180 days.

No being a dislocated worker does not affect FAFSA. At the time when you submit your FAFSA application and your parents are a dislocated worker. This is question 102 on the paper FAFSA.

Federal Student Aid. This means any unemployment benefits relocation assistance or federal disaster aid must all be reported on your FAFSA application. What does a dislocated worker mean.

Are receiving unemployment benefits as a result of being laid off. Dislocated Worker Eligibility Dislocated Worker FAFSA. Federal Student Aid.

This does not apply to a parent to voluntarily leaves their job. You must still report all income taxed and untaxed. Where is the dislocated worker.

It will eventually go on your 22-23 FAFSA if you need it. However FAFSA is the application where everything is reported of the dislocated worker. WHAT DOES DISLOCATED WORKER MEAN FOR FAFSA.

12 Common Fafsa Mistakes U S Department Of Education

12 Common Fafsa Mistakes U S Department Of Education

How To Answer Fafsa Question 83 Dislocated Worker

Calameo Appeal Letter For Financial Aid

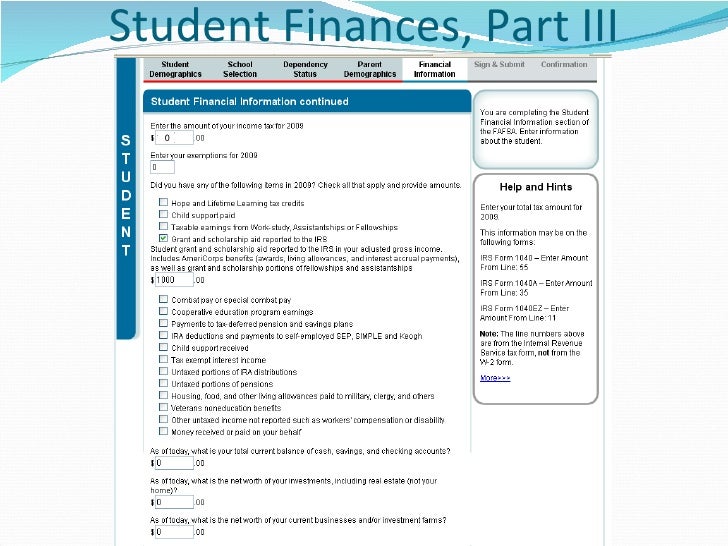

Fafsa Workshop Ppt Video Online Download

Bethune Cookman University Office Of Student Financial Aid Starting Oct 1 2017 You Ll Be Able To Use The Irs Drt With The 2018 19 Fafsa Form For Your Privacy The Tax Information

12 Common Fafsa Mistakes U S Department Of Education

Fafsa Otw Fun With Lisa Simpson

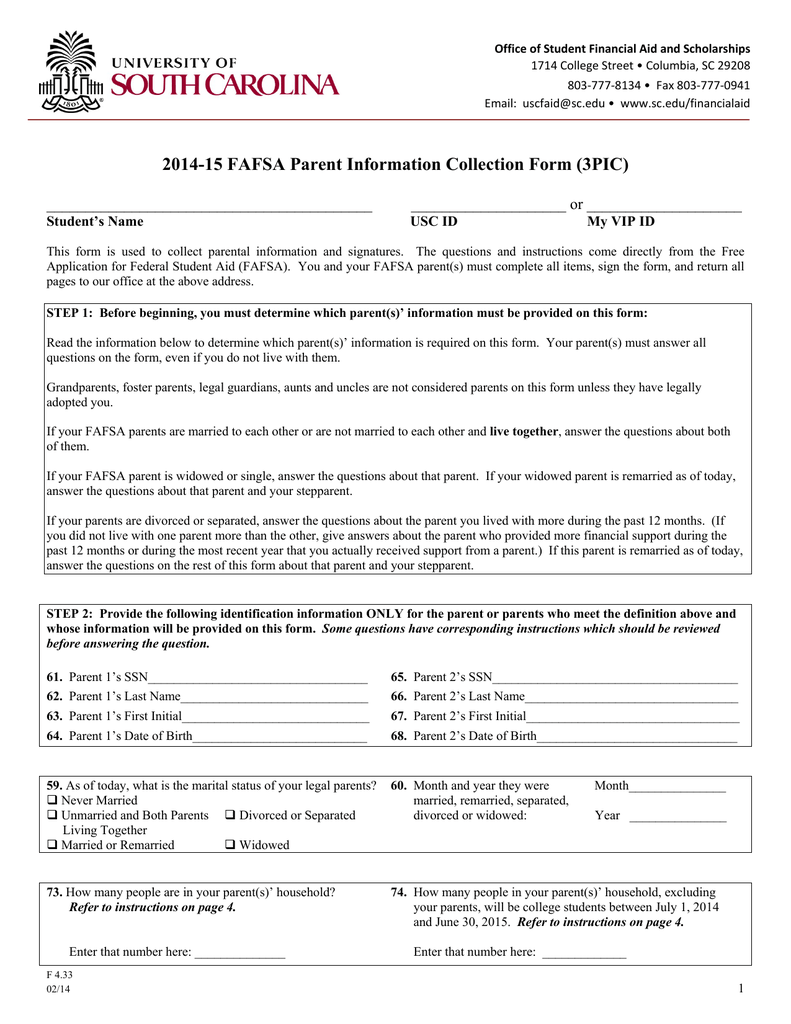

Office Of Student Financial Aid And Scholarships 1714 College Street Columbia Sc 29208 803 777 8134 Fax 803 777 0941 Email Www Sc Edu Financialaid

How To Answer Fafsa Question 100 Dislocated Worker Status

Calameo Job Loss And The Fafsa

What Is A Dislocated Worker On The Fafsa Frank Financial Aid

A Fumble On A Key Fafsa Tool And A Failure To Communicate The New York Times